Understanding Credit Utilization: A Key to Building Strong Credit

Credit utilization is a term that often comes up in discussions about credit scores and financial health. Understanding and managing it can be a game-changer for anyone looking to improve their credit score. In this blog post, we’ll break down what credit utilization is, why it matters, and how you can manage it effectively to boost your credit score.

What is Credit Utilization?

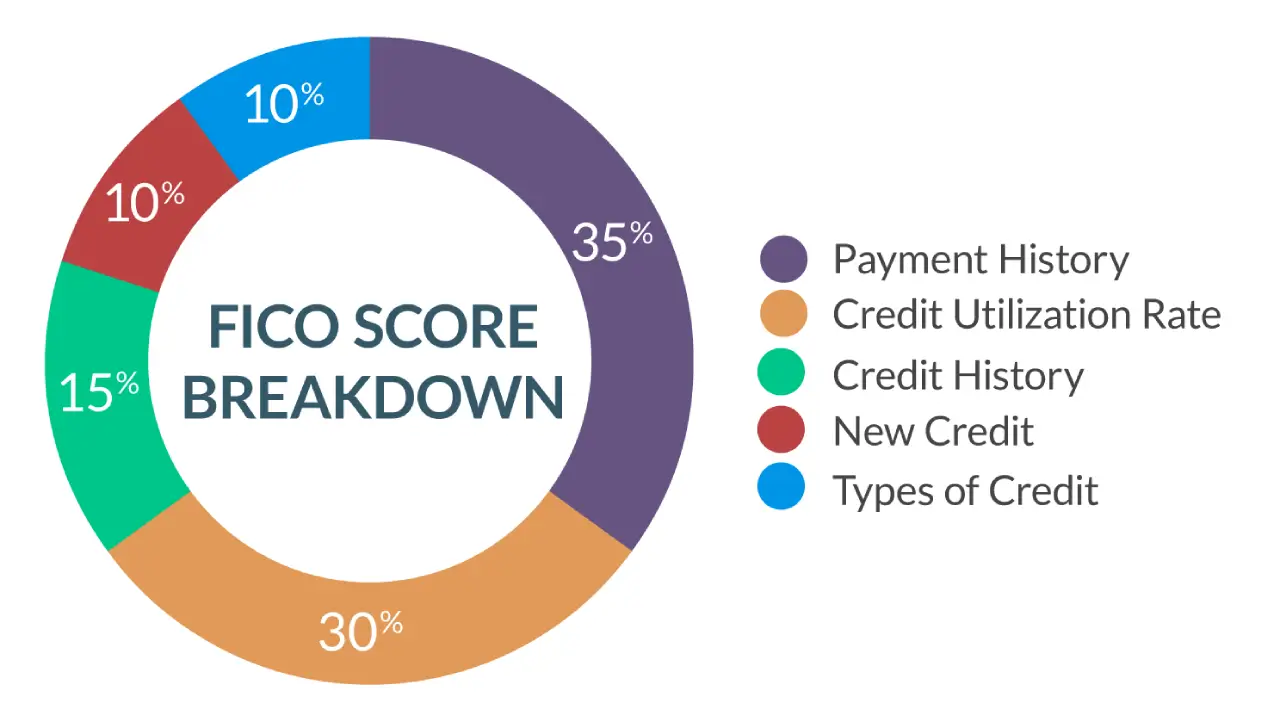

Credit utilization refers to the percentage of your available credit that you are using at any given time. It’s a critical component of your credit score, typically accounting for about 30% of your FICO score, one of the most widely used credit scoring models.

To calculate your credit utilization ratio, use the following formula:

Credit Utilization Ratio = (Total Credit Card Balances / Total Credit Limits) × 100%

For example, if you have a total credit limit of $10,000 across all your credit cards and your current balances total $2,500, your credit utilization ratio is 25%.

Why is Credit Utilization Important?

Credit utilization is a direct indicator of how you manage credit. Lenders and credit bureaus see high utilization rates as a sign of risk, suggesting that you might be over-reliant on credit and potentially overextended. Conversely, a low credit utilization rate indicates that you’re using credit responsibly and not living beyond your means.

Maintaining a low credit utilization rate can positively impact your credit score, making it easier to get approved for loans, credit cards, and favorable interest rates.

Ideal Credit Utilization Rate

Financial experts generally recommend keeping your credit utilization rate below 30%. However, for optimal impact on your credit score, aim for a utilization rate below 10%.

How to Manage and Improve Your Credit Utilization

Pay Down Balances Strategically: Prioritize paying down credit card balances, especially those with the highest interest rates. This not only improves your credit utilization but also saves you money on interest payments.

Increase Your Credit Limits: Contact your credit card issuers and request a credit limit increase. A higher limit can lower your credit utilization ratio, provided you don’t increase your spending.

Distribute Your Debt: If you have multiple credit cards, spreading your balances more evenly can help lower the utilization ratio on each card.

Make Multiple Payments Each Month: Instead of making one payment at the end of the billing cycle, consider paying down your balances multiple times a month. This can keep your reported balances low when your credit is reviewed.

Monitor Your Credit Reports: Regularly check your credit reports for errors that could affect your credit utilization ratio. Dispute any inaccuracies with the credit bureaus to ensure your credit report reflects your true financial situation.

Avoid Closing Unused Credit Accounts: Closing old or unused credit accounts can reduce your total available credit, increasing your credit utilization ratio. Keep these accounts open, even if you don’t use them regularly.

Conclusion

Credit utilization is a vital aspect of your overall credit health. By understanding and managing it effectively, you can take significant steps towards improving your credit score. Remember, maintaining a low credit utilization rate not only boosts your score but also portrays you as a responsible borrower to potential lenders. Stay proactive about your credit utilization, and you’ll be on your way to a stronger financial future.

For personalized advice and strategies, consider consulting with a qualified financial advisor who can help you tailor a plan to your specific financial situation.